Offshore Trust Setup – Fees, Steps, and Professional Guidance

Offshore Trust Setup – Fees, Steps, and Professional Guidance

Blog Article

Checking out the Benefits of an Offshore Trust for Wealth Security and Estate Preparation

When it comes to protecting your riches and intending your estate, an overseas Trust can offer substantial benefits. This calculated device not only secures your possessions from financial institutions yet likewise supplies privacy and possible tax obligation advantages. By comprehending exactly how these counts on function, you can tailor them to fit your unique needs and worths. Yet what certain elements should you think about when developing one? Let's check out the essential advantages and considerations that could affect your choice.

Recognizing Offshore Trusts: Interpretation and Essentials

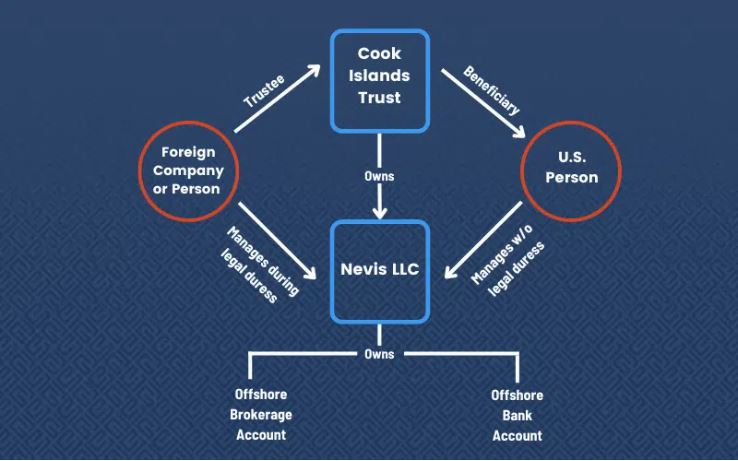

When you're checking out means to secure your wide range, comprehending offshore trusts can be vital. An offshore Trust is a lawful plan where you transfer your assets to a trust taken care of by a trustee in an international jurisdiction. This setup supplies several benefits, including tax obligation advantages and boosted personal privacy. You keep control over the Trust while shielding your possessions from local lawful claims and potential creditors.Typically, you would certainly establish the rely on a jurisdiction that has beneficial laws, assuring more durable asset defense. This suggests your wide range can be secured from suits or unexpected monetary troubles back home. It is essential, however, to recognize the legal implications and tax obligation responsibilities associated with handling an overseas Trust. Consulting with an economic advisor or lawful specialist is sensible, as they can guide you with the complexities and assurance compliance with global regulations. With the right method, an overseas Trust can be an effective tool for protecting your wide range.

Asset Defense: Shielding Your Riches From Lenders

When it concerns protecting your riches from financial institutions, recognizing the lawful framework of offshore trust funds is important. These counts on supply substantial benefits, such as improved privacy and privacy for your possessions. By utilizing them, you can produce a solid barrier versus prospective claims on your wealth.

Legal Framework Advantages

While many people look for to expand their riches, securing those properties from potential creditors is similarly crucial. An offshore Trust offers a durable legal framework that improves your property protection approach. By establishing your Trust in a territory with positive laws, you can effectively shield your riches from insurance claims and claims. These territories frequently have strong privacy legislations and limited gain access to for external events, which implies your possessions are less vulnerable to creditor actions. Furthermore, the Trust structure gives legal splitting up between you and your assets, making it harder for lenders to reach them. This positive technique not just safeguards your riches yet also ensures that your estate planning goals are fulfilled, enabling you to offer your enjoyed ones without unnecessary threat.

Privacy and Privacy

Personal privacy and confidentiality play a critical role in asset security methods, specifically when utilizing overseas depends on. By developing an offshore Trust, you can maintain your financial affairs very discreet and shield your possessions from prospective lenders. This suggests your wealth remains less accessible to those aiming to make claims against you, providing an added layer of safety and security. Furthermore, several jurisdictions offer strong privacy laws, ensuring your information is protected from public analysis. With an offshore Trust, you can appreciate the satisfaction that originates from knowing your assets are secured while keeping your anonymity. Eventually, this level of personal privacy not only secures your riches yet also boosts your total estate preparation approach, enabling you to concentrate on what absolutely matters.

Tax Benefits: Leveraging International Tax Regulation

When you consider offshore depends on, you're not just shielding your properties; you're likewise taking advantage of worldwide tax obligation rewards that can substantially decrease your tax problem. By purposefully positioning your wealth in territories with positive tax legislations, you can improve your property security and minimize estate tax obligations. This technique permits you to enjoy your wide range while ensuring it's secured against unexpected challenges.

International Tax Obligation Incentives

As you check out offshore counts on for wide range protection, you'll find that international tax obligation motivations can greatly boost your financial method. Many territories offer favorable tax obligation treatment for depends on, permitting you to minimize your overall tax obligation burden. For example, specific countries offer tax exemptions or reduced prices on income created within the Trust. By purposefully positioning your properties in an overseas Trust, you could additionally take advantage of tax deferral choices, postponing tax commitments until funds are taken out. In addition, some territories have no capital gains taxes, which can better improve your financial investment returns. offshore trust. This means you can optimize your wide range while lessening tax obligation responsibilities, making global tax obligation incentives a powerful device in your estate preparing arsenal

Property Security Methods

Estate Tax Obligation Minimization

Establishing an offshore Trust not only protects your properties yet likewise offers substantial tax obligation advantages, especially in estate tax reduction. By putting your wealth in an offshore Trust, you can take benefit of desirable tax laws in different jurisdictions. Many countries impose lower inheritance tax prices or no estate tax obligations whatsoever, allowing you to preserve even more of your riches for your beneficiaries. In addition, since assets in an overseas Trust aren't typically thought about part of your estate, you can additionally reduce your estate tax obligation liability. This critical step can result in considerable cost savings, guaranteeing that your recipients receive the maximum gain from your hard-earned wide range. Inevitably, an offshore Trust can be a powerful device for efficient estate tax planning.

Personal privacy and Confidentiality: Maintaining Your Finance Discreet

Estate Preparation: Making Sure a Smooth Shift of Riches

Maintaining privacy through an offshore Trust is simply one facet of wide range management; estate preparation plays an important duty in ensuring your properties are passed on according to your desires. Reliable estate preparation permits you to lay out just how your riches will be distributed, lowering the danger of household conflicts or legal difficulties. By clearly defining your intentions, you aid your beneficiaries recognize their roles and responsibilities.Utilizing an offshore Trust can streamline the procedure, as it commonly gives you with a structured method to handle your possessions. You can mark beneficiaries, define conditions for inheritance, and also describe specific usages for your wide range. This strategic approach not just secures your assets from potential lenders but additionally helps with a smoother adjustment during a difficult time. Inevitably, a well-crafted estate plan can protect your heritage, giving you comfort that your liked ones will be taken care of according to your desires.

Versatility and Control: Personalizing Your Trust to Fit Your Requirements

When it concerns tailoring your offshore Trust, flexibility and control are key. You can customize your Trust to fulfill your specific needs and choices, guaranteeing it lines up with your financial objectives. This versatility allows you to make a decision exactly how and when your possessions are dispersed, providing you comfort that your wealth read is handled according to your wishes.You can choose recipients, set problems for distributions, and also mark a trustee that comprehends your vision. This level of control assists secure your properties from possible threats, while additionally providing tax advantages and estate preparation benefits.Moreover, you can change your Trust as your circumstances alter-- whether it's adding new beneficiaries, changing terms, or addressing shifts in your financial situation. By tailoring your overseas Trust, you not only protect websites your wealth but likewise develop a lasting heritage that shows your worths and goals.

Picking the Right Territory: Aspects to Think About for Your Offshore Trust

Choosing the best jurisdiction for your offshore Trust can significantly influence its effectiveness and advantages. When taking into consideration options, consider the political stability and governing atmosphere of the country. A steady territory decreases risks related to abrupt legal changes.Next, evaluate tax obligation ramifications. Some jurisdictions supply tax motivations that can improve your wealth defense technique. In addition, consider the lawful framework. A territory with strong asset security laws can secure your assets versus prospective claims - offshore trust.You need to likewise mirror on personal privacy laws. Some countries give higher discretion, which can be vital for your comfort. Lastly, analyze the availability of regional specialists who can assist you, as their knowledge will certainly be vital for taking care of the complexities of your Trust

Often Asked Concerns

What Are the Prices Related To Developing an Offshore Trust?

When developing an overseas Trust, you'll encounter costs like arrangement fees, recurring monitoring costs, legal costs, and potential tax obligation implications. It's crucial to assess these costs versus the advantages before deciding.

Exactly How Can I Accessibility My Properties Within an Offshore Trust?

To access your possessions within an overseas Trust, you'll typically require to deal with your trustee - offshore trust. They'll assist you with the procedure, making certain conformity with policies while facilitating your ask for withdrawals or circulations

Are Offshore Trusts Legal in My Nation?

You need to inspect your nation's laws relating to overseas depends on, as policies differ. Several countries allow them, but it's necessary to comprehend the lawful implications and tax duties to ensure conformity and prevent possible concerns.

Can an Offshore Trust Aid in Separation Proceedings?

Yes, an overseas Trust can possibly assist in divorce process by shielding possessions from being split. It's essential to speak with a lawful expert to assure compliance with your local laws and policies.

What Occurs to My Offshore Trust if I Adjustment Residency?

If you transform residency, your overseas Trust might still remain intact, but tax obligation implications and legal considerations can differ. It's important to consult with a specialist to browse these modifications and assurance compliance with regulations. An overseas Trust is a legal setup where you move your possessions to a trust fund taken care of by a trustee in an international territory. You preserve control over the Trust while protecting your assets from neighborhood lawful insurance claims and possible creditors.Typically, you would certainly establish the Trust in a territory that has desirable laws, ensuring even more robust possession protection. Establishing an overseas Trust not just secures your properties but also uses substantial tax benefits, especially in estate tax minimization. By placing your properties in an offshore Trust, you're not only safeguarding them from prospective creditors however additionally ensuring your economic information continues to be confidential.These counts on operate under strict personal privacy legislations that limit the disclosure of your economic information to third celebrations. You can maintain control over your wide range while enjoying a layer of privacy best site that domestic trusts frequently can not provide.Moreover, by utilizing an overseas Trust, you can reduce the risk of identification burglary and undesirable analysis from monetary organizations or tax authorities.

Report this page